Transactions (pre-approval)

Opening the item

Follow the steps below to access transaction details:

Navigate to the Admin Panel

Click Banking on the left sidebar.

Go to the Transactions (pre-approval) menu item.

Click Show in a line to open transaction details.

Component parameters

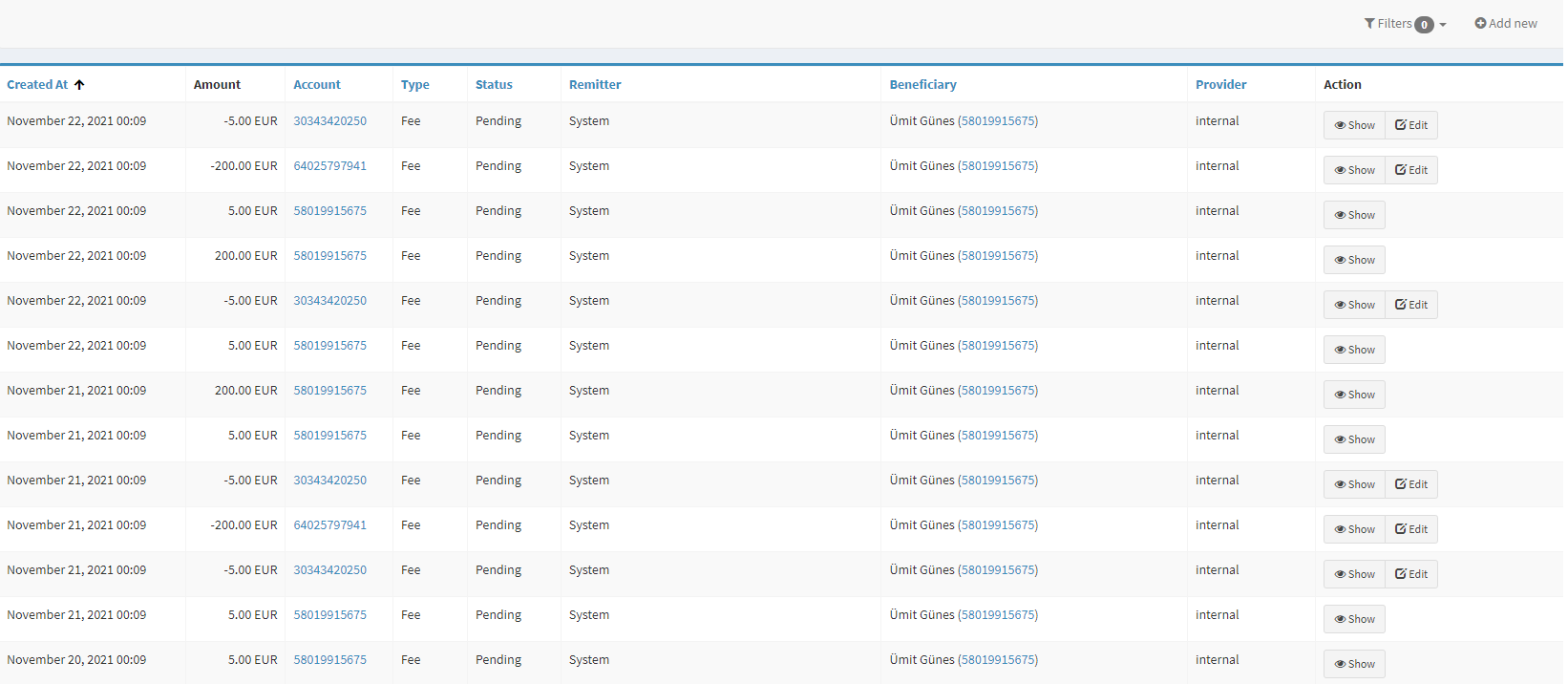

Transactions list

Parameter | Description |

|---|---|

Created at | The column demonstrates the date and time of transaction creation. |

Amount | Includes the transaction's sums. |

Account | Defines the account numbers the transaction belongs to. |

Type | Defines the transaction types that are the following:

|

Status | Defines the transaction status:

|

Remitter | The debited account owner’s name. |

Beneficiary | The transfer beneficiary names and account numbers. |

Provider | The service provider delivering the transaction execution. |

Action |

|

Add new | Create a transaction manually, see the Transactions for details. All transactions are created automatically by service providers; therefore, the transaction creation functionality is designed for testing and/or exceptional cases, such as manual operational needs (for example, charging unique fees). |

Help | Click to access the current page right from the Admin Panel. |

Configuring the component

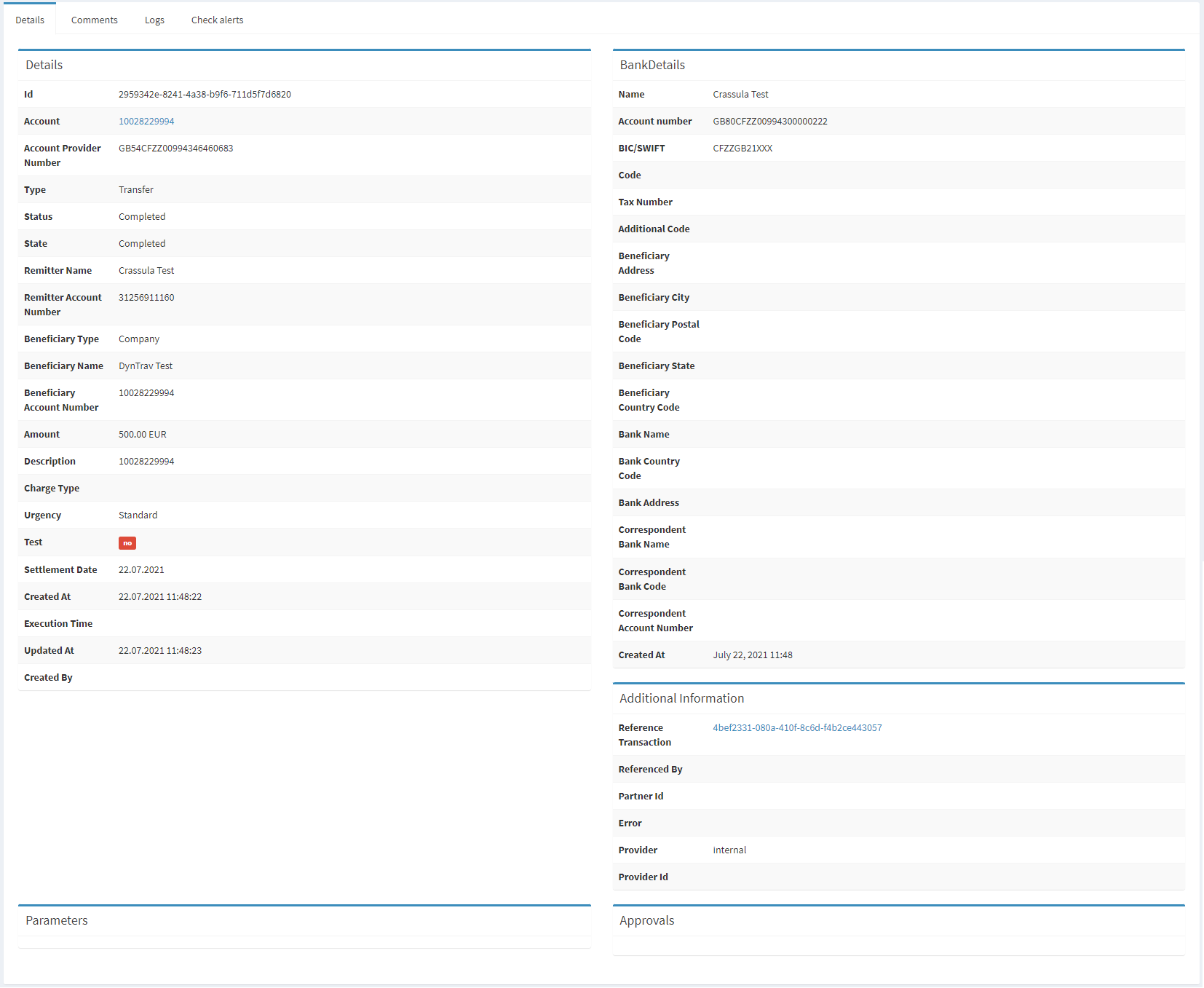

There are two panels for transaction review and editing.

Transaction details

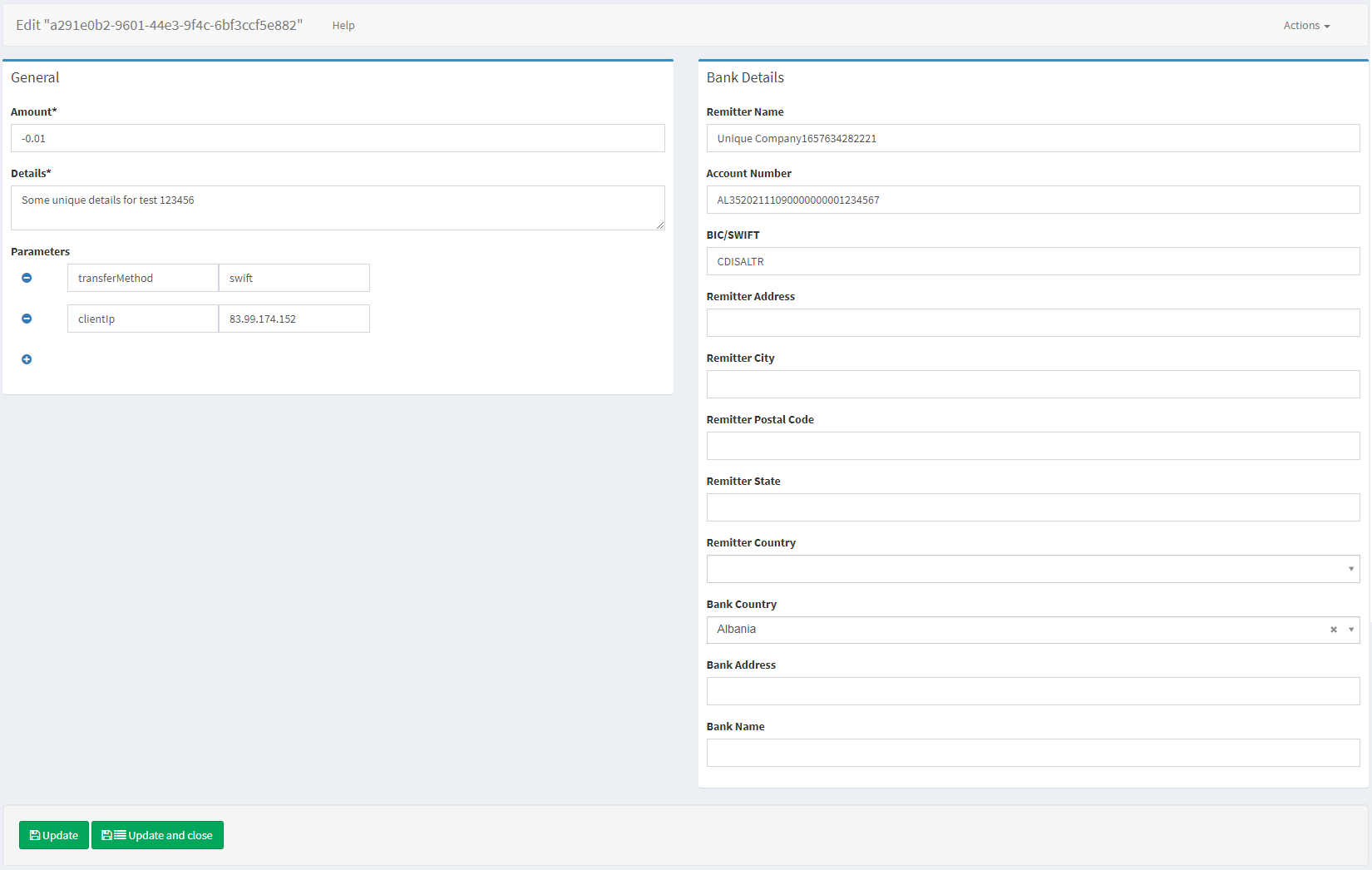

Transaction editing

Parameter | Description |

|---|---|

Transaction details | |

Details | The field includes general transaction information, including an internal ID, related account numbers, sums, and currencies. |

Bank Details | Demonstrate the essential banking details, including SWIFT, IBAN, and legal addresses. |

Additional information | Provides the information on the transaction service provider and a reference transaction (if provided). |

Reference Transaction | A “reverse” of the initial transaction. Every transaction charged from an account will be credited to another one. For example, a fee charged from a user will be transferred as a commission to a Bank cash account – in this case, the credit transaction on the cash account is a reference transaction of the initial fee. |

Approvals | The field demonstrates the list of pre-approvals if applied. |

Top sidebar | Navigate among Details, transaction Logs, Comments, and Check alerts using the top-side menu. |

Transaction editing | |

State | Transaction state defines whether the transaction is drafted, waiting for approval, complete, or declined. The transaction state is changed by the transaction service provider; change the state only in case of emergency. Note, if you change a transaction state, it will be updated only in the Crassula system. The following list defines all transaction states with corresponding API codes that can be required by development teams:

|

Amount | Transaction amount. |

Details | The field allows changing the banking details in case of any errors or misprinting. Once a transaction is complete, it is not possible to change its Bank Details. In order to manage the banking details, the transaction state is to be rolled back manually. |

Help | Click to access the current page right from the Admin Panel. |

.png)