Accounting (Banking reports)

Opening the item

Follow the steps below to access Accounting reports:

Navigate to the Reports section of the Admin Panel.

Click Banking on the left sidebar

Go to the Accounting menu item.

How to export a report

Most of the banking reports are sufficient without being exported, though there is always a possibility to export them as an .xls, .csv, .json, or .xml file.

To export a report

Navigate to the Accounting reports window.

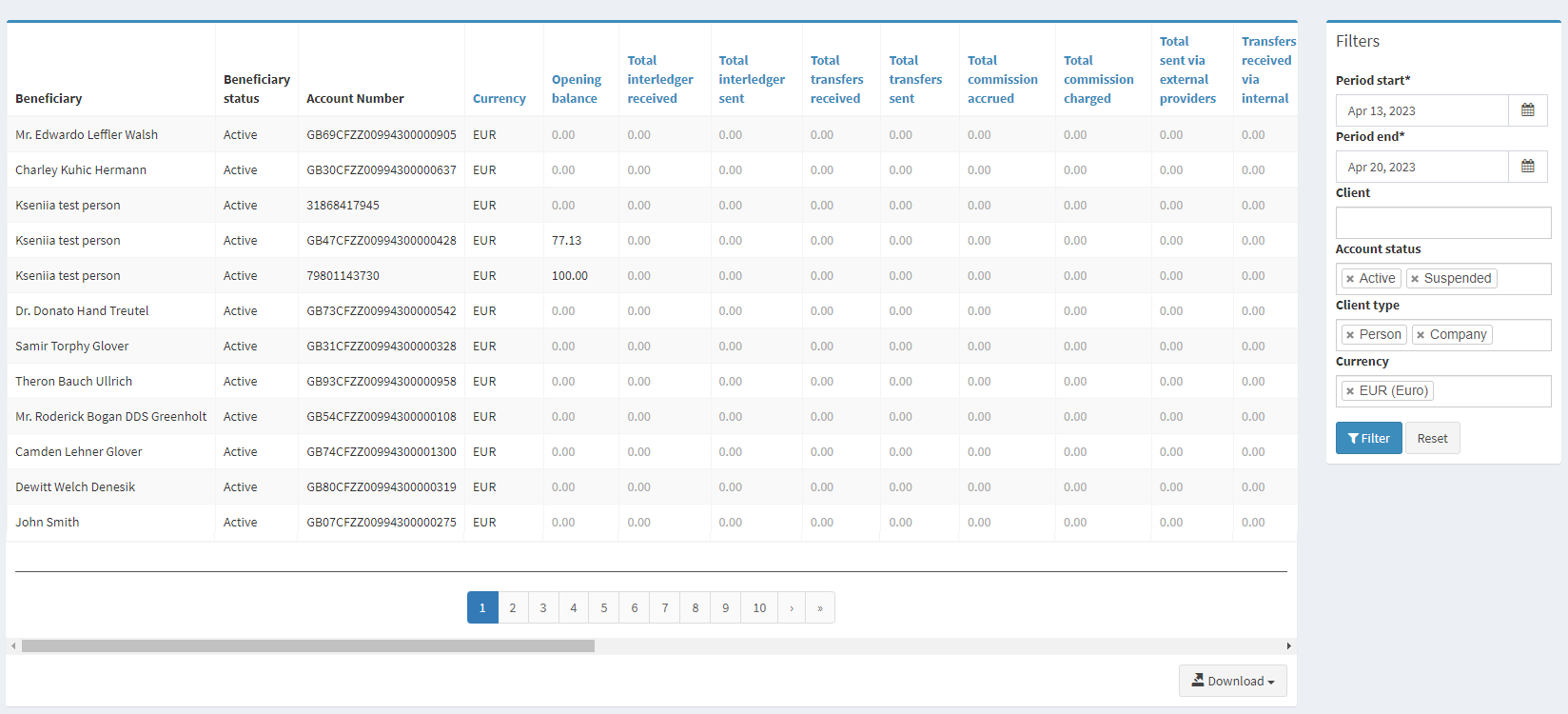

Set the Period start and Period end parameters to define the time period that must be considered. The parameters are mandatory.

Type in a client name in the Client field if you need the report to contain details of an exact client.

Set the Account status parameter to define which client Aggregated status must be considered in the report. Active and Suspended statuses are included by default.

Set the Client type parameter to define whether Persons and/or Companies must be considered in the report. Both client types are included by default.

Set the Currency parameter to filter out accounts by currency. The parameter is set to EUR by default.

Click Filter. The list will be updated according to the configuration.

Click Download and select a file type for export if you need to access the report outside of the Admin Panel.

Component parameters

Accounting report

Parameter | Description |

|---|---|

Beneficiary | The name of the account owner. |

Beneficiary status | Account owner aggregated status that defines whether there are restrictions set by KYC Administrators or Identification providers. |

Account Number | Account number, IBAN, or crypto wallet address. |

Currency | Payment currency. |

Opening Balance | Account balance at the period start. |

Total interledger received | The total amount of payments received from interledger accounts. The interledger functionality is applicable when making payments between different payment networks and systems (if enabled). |

Total interledger sent | The total amount of payments sent to interledger accounts. The interledger functionality is applicable when making payments between different payment networks and systems (if enabled). |

Total transfers received | The total amount of payments received during the defined period. |

Total transfers sent | The total amount of payments made during the defined period. |

Total commission accrued | The amount of fees received by the White Label’s account. |

Total commission charged | The total amount of fees charged from the client during the defined period. |

Total sent via external providers | The total amount of external payments made in the account. |

Transfers received via internal | The total amount of internal payments received in the account, i.e., payments received from other White Label clients. |

Transfers sent via internal | The total amount of internal payments made in the account, i.e., payments sent to other White Label clients. |

Commission accrued via internal | The amount of fees received by the White Label’s account for internal payments, i.e., payments between White Label clients. |

Commission charged via internal | The total amount of fees charged from the client for internal payments, i.e., payments between White Label clients. |

Transfers received via sepa_manual | The total amount of manual payments received during the defined period. The parameter is available only if there are payments made by the sepa_manual service provider. See Manual payments for details. |

Transfers sent via sepa_manual | The total amount of manual payments sent during the defined period. The parameter is available only if there are payments made by the sepa_manual service provider. See Manual payments for details. |

Commission accrued via sepa_manual | The amount of fees received by the White Label’s account for manual SEPA payments. See Manual payments for details. |

Commission charged via sepa_manual | The total amount of fees charged from the client for manual SEPA payments. See Manual payments for details. |

Deposited via cards | The total amount of funds deposited with a card, i.e., the deposits made in the Web Interface. |

Deposited by operators | The total amount of funds deposited by an administrator, i.e., the deposits made in the Admin Panel. |

Withdrawn by operators | The total amount of funds withdrawn by an administrator, i.e., the withdrawals made in the Admin Panel. |

Refunds | The total amount of refunds during the period. |

Recalls | The total amount of recalls during the period. |

Converted from currency | The total amount of conversion transactions from the account currency. |

Converted to currency | The total amount of conversion transactions to the account currency. |

Card purchases | The total amount of card purchases during the period. |

Card withdrawals | The total amount of card withdrawals during the period |

Closing balance | Account balance at the period end. |

Outgoing pending operations | Transactions that have been initiated but not yet fully processed or cleared from the account. These may include payments, transfers, or other debits that reduce the available balance but have not been finalized. |

Incoming pending operations | Transactions that have been initiated but not yet fully processed or cleared into the account. These include deposits, transfers, or other credits that increase the available balance but are still pending finalization. |

Actual balance | Represents the current available balance calculated according to the following formula: |

.png)