Accounts

Opening the item

Follow the steps below to access the account details:

Navigate to the Admin Panel.

Click Banking on the left sidebar.

Go to the Accounts menu item to open the Accounts List.

Click Show or an account number in the Number column to open the details.

How to open an Account

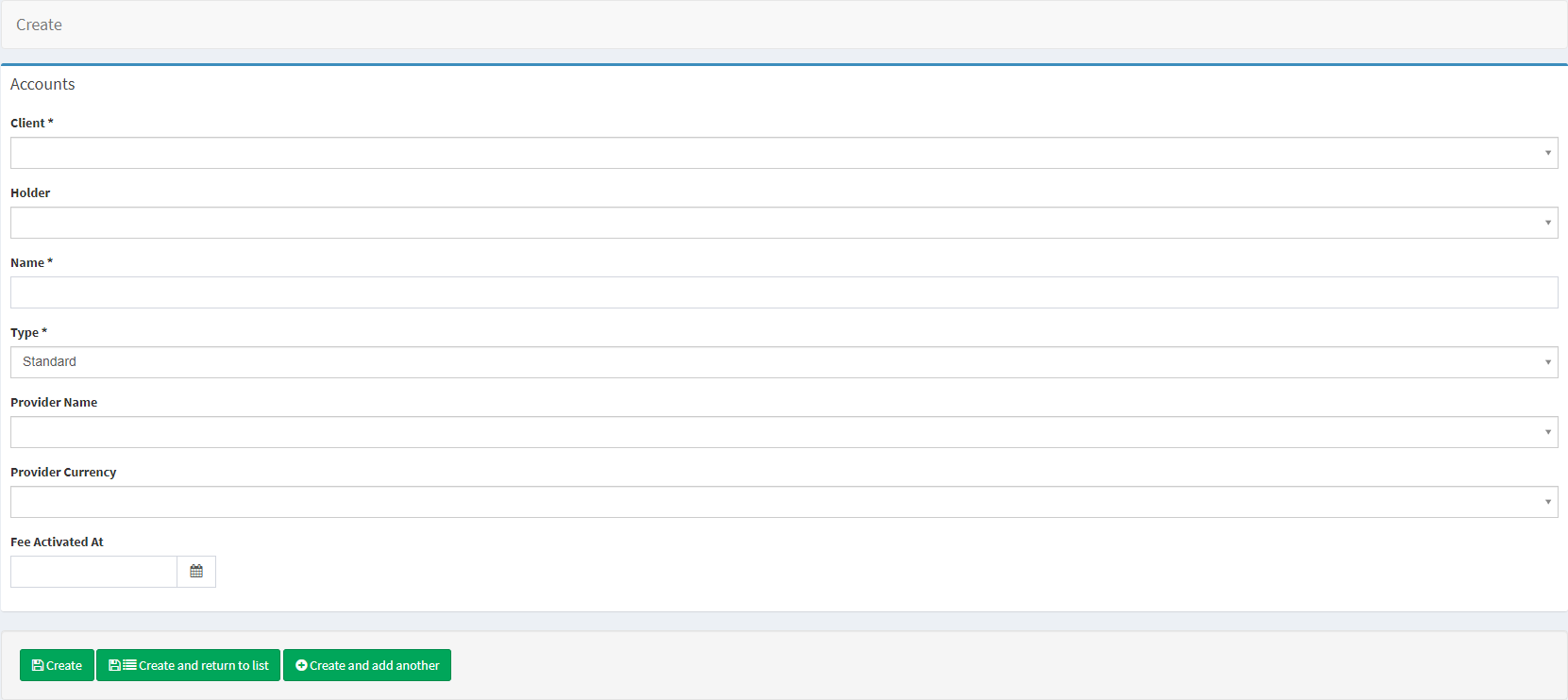

To open an account

Navigate to the Accounts menu item.

Click Add New in the top-right corner of the tab.

Type in a Client’s name or email to find the Client you want to open an account for. The field is mandatory, and an existing client is required. If the Client is not registered yet, see Persons and Companies for details.

Type in the account name in the Name field.

Select the type of account from the Type drop-down menu.

The Fee activated at parameter is optional. Set the parameter if a Price list is available; see Price lists for details.

Click Create to confirm the account opening. An internal account number will be generated.

Component parameters

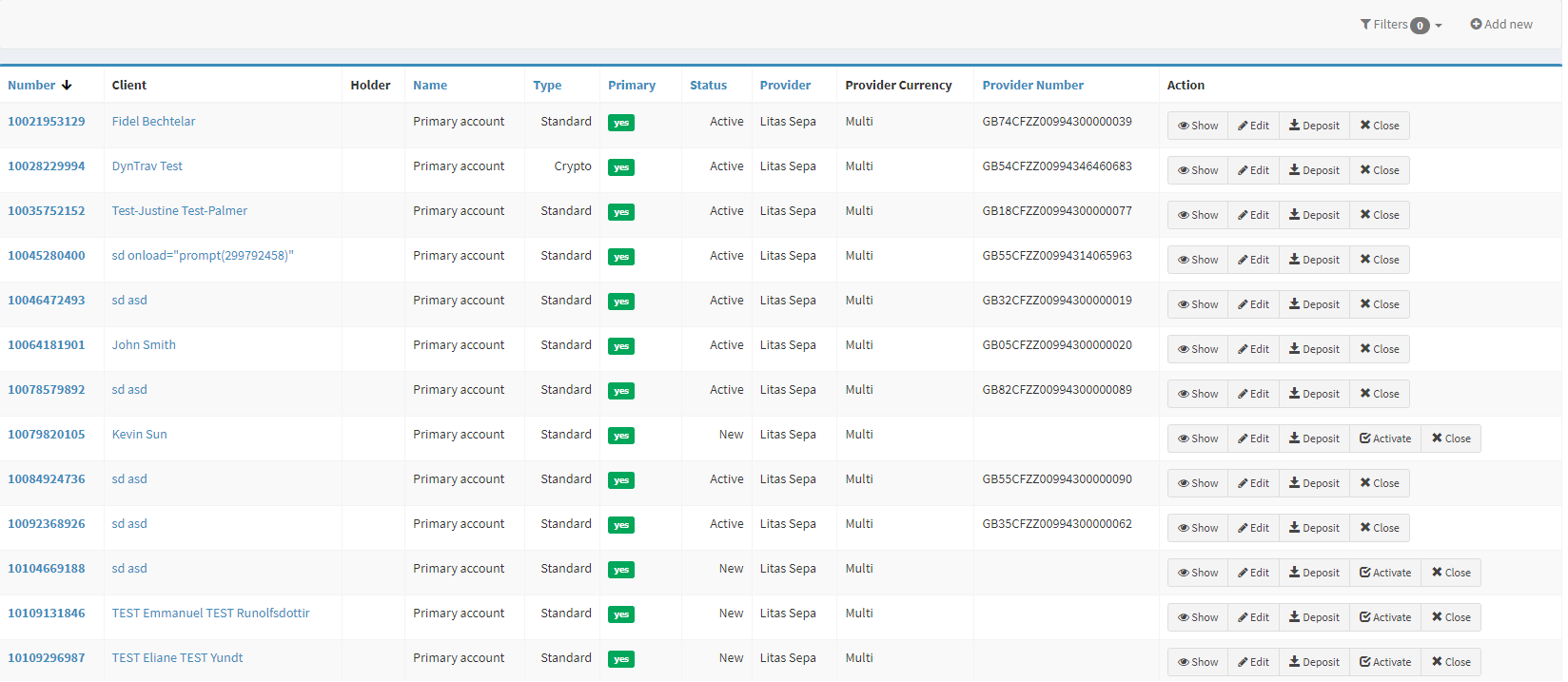

Accounts list

Parameter | Description |

|---|---|

Number | The column demonstrates internal account numbers. At the same time, internal account numbers are used as entity IDs that are available in the Activity log section. Click a Number to open the Account details. |

Client | The column includes the names of clients and the accounts are assigned. Click a Client Name to open profile details. |

Holder | An additional account holder who is entitled to use the account via the Web and Mobile Interfaces. |

Name | Account names are demonstrated in the column. The names of additional accounts are set by the Client at the moment of account opening. |

Type | Three main account types are available for opening:

|

Primary | Account priority status. Mostly, Primary accounts are opened first and used for fee charging. |

Status | Account verification status:

An account is to have a zero balance in order to be closed. Navigate to the Accounts list and click Close to settle an account. Make sure to differentiate Status from Aggregated status available in Banking Reports. Aggregated status is set according to the following logic:

CODE

|

Provider | The name of the account opening provider.

Accounts with no service provider defined in the Provider field are created without account details and can be used for manual transactions. When a manual payment is sent from such accounts, it is processed virtually with no real funds engaged: it is up to the White Label to choose a method of how to deposit real funds to the recipient’s account. Additionally, a White Label can manually generate IBANs for such accounts, though other account details will not be visible in the UI. |

Provider currency | Account currency (displayed when provided) set at the moment of account opening. The parameter is available only for mono-currency accounts. |

Provider currencies (plural) | Account currencies (displayed when provided). The parameter is available only for multi-currency accounts. If there are no currencies selected at the moment of account opening, they are set according to the system configs. |

Provider number | An IBAN generated by the financial service provider. Once the IBAN is generated, it is not possible to change it. |

Action | Show or edit account details.

Profile and accounts are provided with their own unrelated states. Therefore, both profile and account statuses are to be changed in order to set restrictions for a Client. Account information remains in the Crassula system even if the account is closed by the Client or Administrator.

The Deposit action has no “real-money” basis; therefore, it should be used in exceptional cases, and the Provider deposit transaction is to be finally executed.

|

Filters | Search for accounts by certain parameters. Search is filtered by the following parameters; multiple-choice is available:

|

Add new | Open an account manually, see the following sections for details |

Help | Click to access the current page right from the Admin Panel. |

Configuring the component

Account details is the main panel of account information display and editing.

Account details

Parameter | Description |

|---|---|

Details | Account information, including the Client name, account number, and account type. The field includes the following special parameters:

|

Statement | Download a list of account transactions for a selected period. To export a statement

The system will process large reports and will inform the user with the Export in progress message. Once the processing is done, the download will start automatically. It is recommended to keep the window open. |

Provider | Account provider details, such as the following:

|

Provider account numbers | Account numbers delivered by the service provider. The field displays all account numbers, currencies, and requisites for the opened account; a multi-currency account can be provided with several account numbers. There is an additional parameter available for the Clear Bank service provider:

|

Balances | Account balance in detail:

|

Account Transaction Synchronizations | The section provides a detailed report of transaction synchronization performed between Crassula and Railsr. Wait for the report to be processed ( |

Transactions | Recent account transactions list (see Statement for the detailed list).

|

Cards | The field demonstrates all cards issued to the account |

Top sidebar |

|

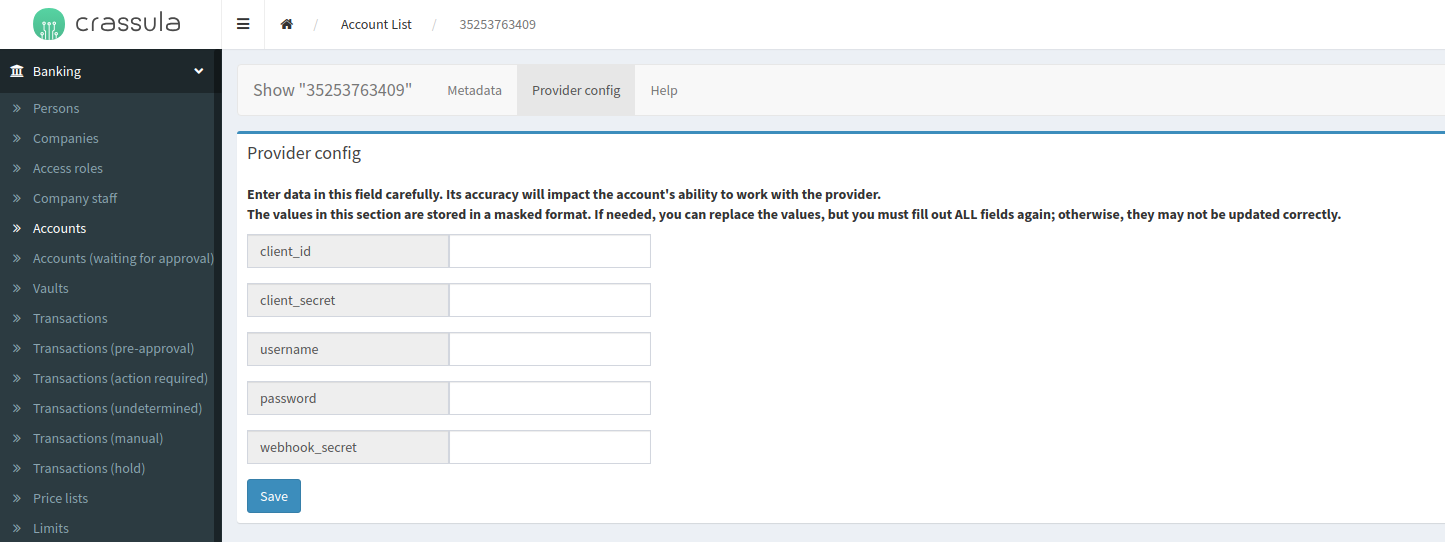

Provider config

The tab includes functionality for managing accounts that should be manually connected to service providers, such as IFX Real, by linking the account with the provider’s system and IBANs. While this currently applies to IFX Real, additional providers will be added in the future.

Manual Credentials Setup

Administrators are required to log into the provider’s dashboard, retrieve the necessary credentials, and enter them into the "Provider Config" section of Crassula’s Admin Panel. Once this step is completed, the account will be connected to the service provider and fully functional.

Make sure administrators are provided with the Accounts > Provider config access role. Editing is restricted and available only for Super Admins.

Useful tips

Use filters in the Account List top-right corner for better navigation.

Click Actions > Edit in the Account Details top-right corner to change the account details.

.png)