Price lists

Opening the item

Follow the steps below to see the price list details:

Navigate to the Admin Panel.

Click Banking on the left sidebar.

Go to the Price lists menu item.

Click Show or Edit in a price list line to open its details.

How to create a price list

The process of configuring fees and rewards consists of the following steps:

Creating a price list.

Adding fee and reward rules to the price list.

Publishing the price list and assigning it to clients.

The first step in configuring transaction fees or reward programs is to create a price list defining the common parameters.

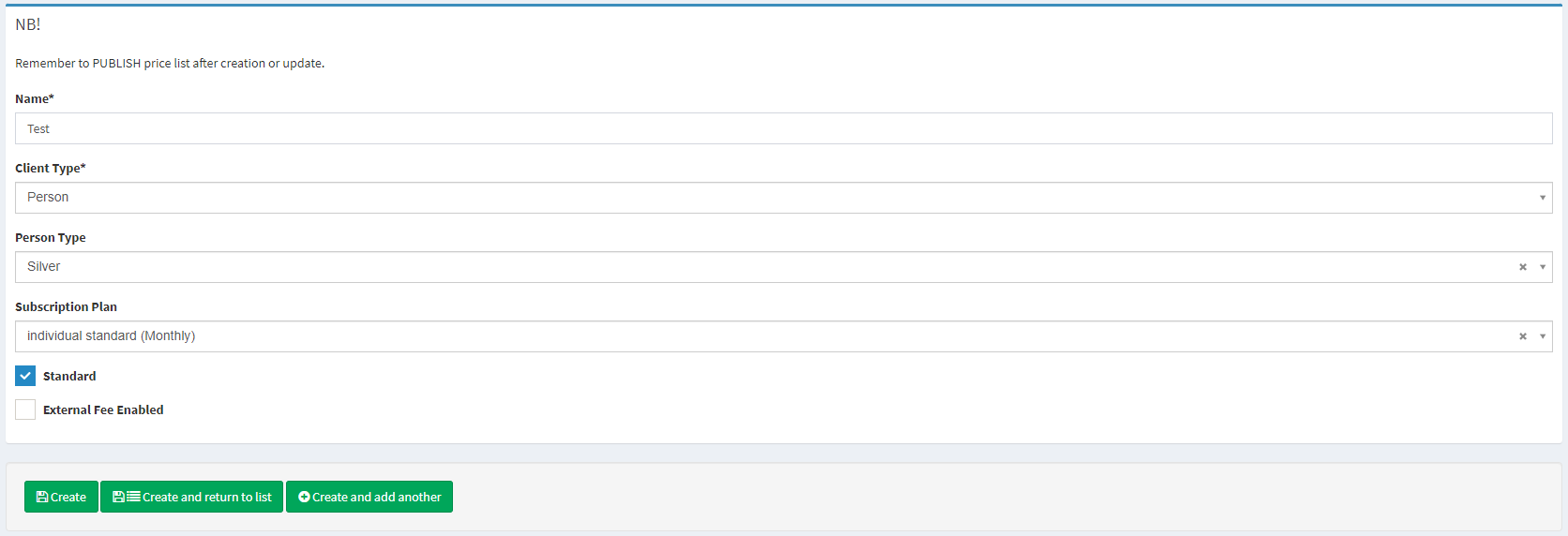

To create a price list

Navigate to the Price lists tab in the Banking sidebar.

The list of price lists will be opened.

Click Add New in the top-right corner to open the price list creation window.

Type in a name for the new price list.

Select a Client type for the price list: either Person or Company. The price list rules will be applied only to the selected client type.

Select a Person/Company type, Client Subtype, Subscription plan to define the group of clients assigned to the new price list.

If the parameter is not set, the new price list will be applied to all clients of the selected Client type.

The groups are configured in Dictionaries and allow White Labels to set limits and price lists per each group. See Dictionary for configuration details.Check the Standard checkbox if you want the price list to be set by default for the selected client type, subtype (if exists) and subscription plan (if exists). There is only one Standard price List possible for each combination of these parameters.

Select the External fee enabled checkbox to request transfer fees from an external service via API. The internal price list configuration for transfers will be ignored.

Click Create to save the price List as a draft.

The new price list will be available in the main list of the price lists tab.

Creating a price list

How to create a price list rule

Once the common parameters are set, it is possible to specify fees and rewards applied to clients of the selected type. The following sections provide step-by-step guides for each type of rules; though, all of them correspond to the following properties:

System transaction processing:

A WL requires its own Company profile to process system transactions. The WL Company must have an account for each of the following purposes; such accounts are requested from the Crassuale technical support:

To receive fiat amounts charged from clients according to fee rules. Each currency set in the rules must be provided with a Standard account.

To receive crypto amounts charged from clients according to fee rules. Each cryptocurrency set in the rules must be provided with a Crypto account.

To send fiat amounts rewarded to clients according to Cashback and Vault rules. Each currency set in the rules must be provided with a Standard account.

Common details:

Each rule is to be added separately to the price list.

Validity period details:

It is possible to configure a price list rule for future usage by defining the validity period starting from a day in the future. Thus, the end-user can set when a rule is to be activated.

The defined period starts at 00:00 UTC and ends at 23:59 UTC.

price list rules cannot be applied to past dates set in the Validity parameters—only current and future dates will be valid.

If validation parameters are not stated, the rule will be valid from the current date and unlimited in time

Amount field details:

If you do not need some of the Amount fields to be stated, leave them with zero values.

Make sure that Maximum fee is not less than Minimum fee.

If the Currency parameter is set to Any currency, it is not possible to set the Fixed fee, Minimum fee, and Maximum fee parameters due to uncertainty in conversion.

Calculations:

Annual percent rates—used in Vault rates, Annual Balance fees, and Unauthorized Negative Balance fees—are calculated every calendar day according to the annual interest rate set in the Percent parameter. The fee/reward calculation is performed daily for the end-of-day balance as follows.

For example, if the Percent parameter is set to 0.5, the daily calculation is performed as follows:

MATHEMATICA0.5*(end-of-day balance)/100/365At the end of the period, the end-of-day calculations are summarized and Client is charged/rewarded for all days in the period.

For example, if the Percent parameter is set to 0.5, the Period is set to Month, and the account balance has not changed for the whole period, the fee/reward for a month having 30 days is calculated as follows:MATHEMATICA0.5*(end-of-day balance)/100*30/365

Fee types

The following fee types are available in the top sidebar of a price list configuration window:

Transfer fees: Configure one-off transaction fees. See Transfer fees for additional details.

Recurring fees: Configure recurring fees that must be charged from the Client’s Primary account every defined period of time. See Recurring fees for additional details.

Issued card fees: Configure new card fees. See Issued card fees for additional details.

FX markup fees: Configure currency conversion fees. See FX markup fees for additional details.

Cashback: Configure reward rules. See Cashback for additional details on the functionality.

Vault rates: Configure interest rates and lock-up periods for time deposits. See Vaults for additional details on the solution.

Change verification level fee: Configure fees for upgrading and downgrading a verification level. See Change verification level fees for additional details.

Subscription plan fee: Configure transition fees for upgrading and downgrading a subscription. See Subscriptions for additional details on the functionality.

How to assign a Price list

Once a price list is configured, it must be assigned to a client to take action; otherwise, a Standard price list will be used for the client.

A price list is to be created and published before being assigned to a Client. If you have not created a price list yet, see the previous sections for details.

To assign a Price list

Make sure the price list is published if no other fees need to be added.

Navigate to the Persons or Companies tab, depending on the Client type of the price list.

Select a Client you need to apply the price list to.

Click Edit in the corresponding line.

Navigate to the Settings field of the Profile.

Click Price Lists.

Select a price list in the drop-down menu. Unless a price list is not selected, the Standard price list is applied to the Client.

Click Update to apply the changes.

Component parameters

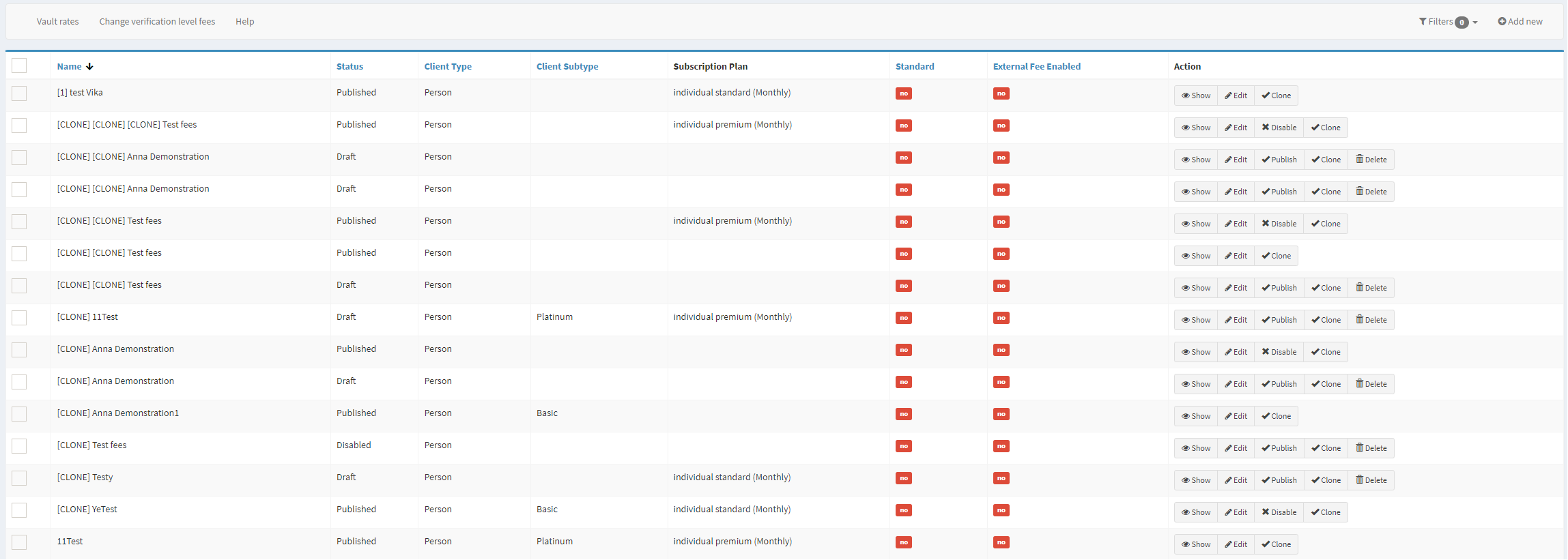

Price lists

Parameter | Description |

|---|---|

Name | The column includes the names of created price lists. |

Status | Defines the price list status:

|

Client type | Defines the user type the price list is applied to: |

Client subtype | Defines the group of Persons or Companies assigned to the price list. If the parameter is not set, the new price list will be applied to all clients of the selected Client type. |

Standard | Defines whether the price list is Standard. A Standard price list is a unique combination of fees that is created once and set to a Person or a Company by default if otherwise is not stated. There is only one Standard price list possible for each client type. The parameter can be set in the Edit mode. |

External fee enabled | If the option is set, transfer fees will be requested from an external service via API. The price list configuration for transfers will be ignored. The parameter can be set in the Edit mode. |

Action |

|

Filters | Search for price lists by name, status, and client type; multiple-choice is available. |

Add new | Create a price list manually, see the following instructions for additional details. |

Help | Click to access the current page right from the Admin Panel. |

Configuring the component

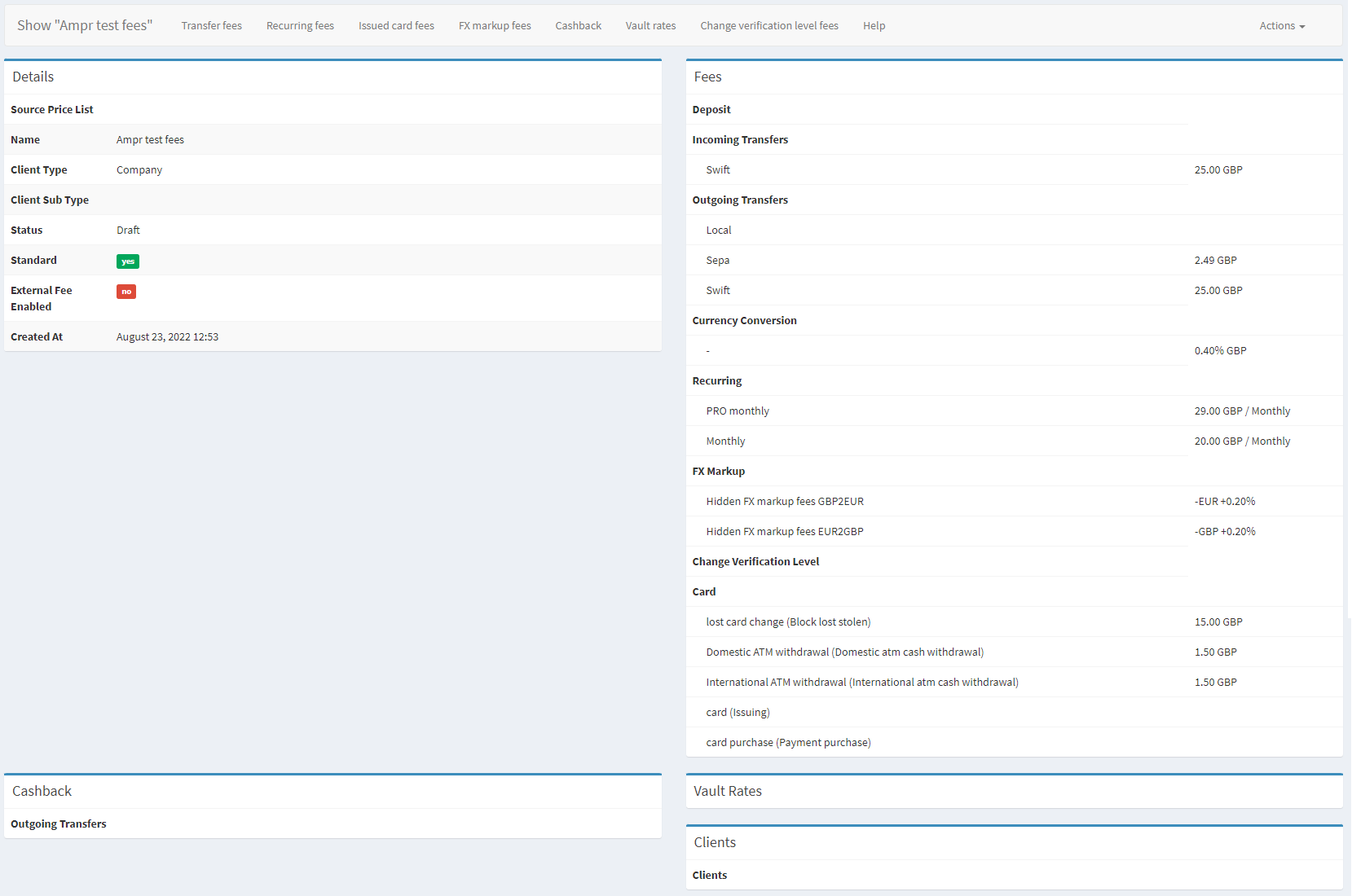

The Price lists details window provides common details of a price list and its rules.

Price list details

Parameter | Description |

|---|---|

Details | The field defines general info demonstrated in the list of the existing price lists. |

Clients | The field demonstrates all clients the price list is applied to. |

Fees | The field defines the list of all fees included in the price list. |

Cashback | The field defines the list of all cashback rules included in the price list. |

Top sidebar |

|

Advanced behavior

Transfer fees are charged according to the four criteria that are considered in the following priority:

Payment Method: The parameter of the 1st priority. If the parameter is set for a transaction and a fee rule, the fee will be charged accordingly.

Account Provider: The parameter of the 2nd priority. If Payment Method=Any, the fee with the corresponding Account Provider parameter will be selected.

Transfer Provider: The parameter of the 3rd priority. If Payment Method=Any and Account Provider is not set, the fee with the corresponding Transfer Provider parameter will be selected.

Currency: The parameter of the 4th priority. If no other criteria parameters are set, the fee with the corresponding Currency parameter will be selected. If there are no fees with the corresponding currency, the fee will be charged in any currency that can be converted into the payment currency.

It is highly recommended to define all the criteria parameters to avoid unexpected behavior.

The Account Provider must be set either for all fees, or for none of the fees in the price list. Otherwise, the fees will not be charged.

.png)